Forget boxing matches, the real fight is happening in your head. In one corner, is the thrill-seeking, adrenaline-pumping world of sports betting. On the other, the slow and steady, long-term grind of investing. Both promise riches, but only one can be crowned the champion of your finances.

To help you make the right choice, we’ll break down their similarities and differences and see how sports betting compares to investing. By the end of this blog, you’ll be armed with the knowledge to conquer the casino, outsmart the market, and build a fortune that’s as exciting as it is secure!

The Basic Differences Between Betting and Investing

- The most obvious difference between betting and investing is that sports bettors rely on predicting the outcomes of sporting events. Investing is when you buy into the future growth of assets.

- Sports betting is a short-term activity where you get the results in hours or days. On the other hand, investing is a long-term activity where returns are often expected years later.

- Sports betting requires some level of skill and knowledge, but you’ll need a lot of luck. Investing relies more on skills and knowledge, which are needed to understand the different types of assets and analyse their data.

What is Sports Betting?

In simple terms, sports betting is when you bet money on what you think will be the result of a sports event. Typical betting options include predicting the winner of the game, the final score, or the total number of points scored.

What is Investing?

When you invest, you are essentially buying a piece of an asset like a stock, bond, or real estate. The goal is for the value of the asset to increase over time, and you can sell it for profit!

Similarities Between Betting and Investing

- Risk and Reward – Both betting and investing involve risk. When you bet, you risk losing your money. That’s why they always say: “Only bet what you can afford to lose”. Similarly, when you invest in an asset, you also risk the possibility of losing money if the asset’s value drops!

- Research and Analysis – Research is key whether you choose betting or investing. If you’re a bettor, you’ll need to understand the factors that may influence the outcome of the event. If you’re an investor, you’ll need to analyse the performance of your chosen asset to make an informed decision!

- Goal Setting – Setting clear and realistic goals is also something that both bettors and investors share. No one wants to spiral into losing all their money trying to reach an unrealistic win in sports betting. Investors should also set realistic goals that align with their risk tolerance.

Risks and Opportunities

Like a double-edged sword, sports betting and investing present many ways to lose and win. When deciding between the two, it’s important to carefully consider the potential wins and the risks in sports betting vs the risks in investing.

Risks of Sports Betting:

- Unpredictability: The internet may tell you otherwise, but sports events are inherently unpredictable. They can be influenced by various factors beyond anyone’s control, making it very challenging to make a steady profit.

- Psychological Factors: Sports betting can evoke strong emotions that can lead to chasing losses and losing much more money than was earned.

Opportunities of Sports Betting:

- Entertainment Value: Sports betting is an entertaining pastime. It’s fun, tests your knowledge of the events, and you get a reward if you win!

- Short-Term Gains: With strategic betting and a lot of discipline, sports bettors can make short-term financial gains.

Risks of Investing:

- Market Fluctuations: Sometimes, no matter how much you prepare, the stock market will fluctuate and can cause unexpected losses.

- Economic Factors: Economic conditions like inflation, interest rates, and geopolitical events can significantly impact investment performance.

Opportunities of Investing:

- Long-Term Growth: Investing is a tested way to create long-term wealth. In fact, many of today’s wealthiest individuals have amassed their fortunes by investing in innovative ideas or technology at early stages, which later generated millions. Shaquille O’Neal first heard about Google in 1999. He invested $250,000 and has reportedly earned $400 million!

- Compounding: Compounding is when you earn interest on your interest. Let’s say you invested $1,000 and earn an annual interest rate of 10%. After one year, you get $100 in interest, with a new total of $1,100.

In the second year, you earn interest on both your original investment of $1,000 and your interest earnings of $100, for a total of $110. Your account balance is now $1,210!

Analysing and Researching Before Making Decisions

Before you throw your hard-earned money into either the stock market or the sports arena, arm yourself with knowledge through research and analysis.

For Sports Bettors:

- Know the Game: If you’re going to bet on the results of a game, at least learn the rules. Research stats, past performances, injuries, and even weather conditions that can affect the results. Imagine betting on a star player who’s secretly nursing a nagging ankle injury!

- Compare Odds: Odds can vary significantly between different sportsbooks. Compare them and find the best value for your bet.

For Investors:

- Company Research: Don’t just jump on the bandwagon because everyone’s buying “the next big thing.” Dig deep into the company’s financials, read analytical reports, and understand its business model, and only then decide.

- Market Trends: The stock market is a living, breathing beast. Try to stay on top of the economic news, industry trends, and global events that can impact your investments.

The Influence of Emotions on Decisions

In this matter where logic is most needed, emotional involvement in betting and investing can be your worst enemy.

The Thrill of the Win

- Sports Betting: Imagine the bliss when that last-minute touchdown secures your victory! This feeling can be addictive and potentially cloud your judgment.

- Investing: Who doesn’t love seeing their portfolio soar green? The pride of picking a winning stock or riding the wave of a booming market can be intoxicating. But beware, this emotional high can lead to chasing returns and ignoring red flags.

The Sting of Loss

- Sports Betting: We’ve all experienced the bitter taste of a bad call. The anger and frustration that follow a losing bet can tempt you to double down on stakes, digging yourself into a deeper financial hole.

- Investing: Watching your hard-earned savings dwindle with a market downturn is no picnic. Fear, anxiety, and even panic can fog your mind which can lead to portfolio changes that you might regret later.

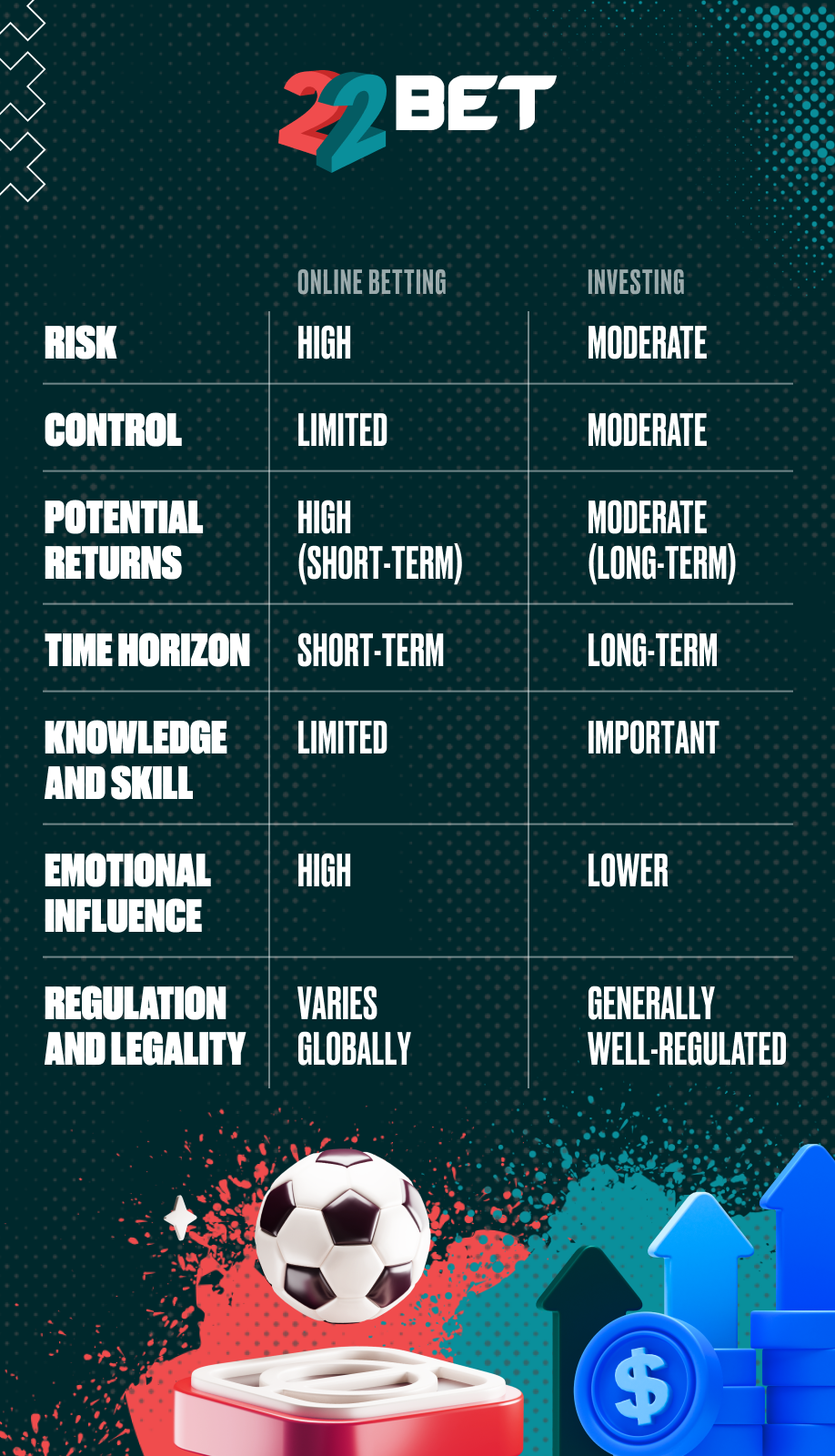

Key Differences

While both sports betting and investing involve putting your money on the line in hopes of a return, their differences are stark. Let’s break them down:

Control

- Betting: Since you’re predicting the outcome of a sports event, there isn’t much you can do to influence it. Sure, you can analyse the stats, but luck still plays a massive role.

- Investing: While market forces play an important part, diversification gives you more control. You’re not just a spectator when investing, you’re actively shaping your financial future.

Risk and Reward:

- Betting: The potential for big wins is undeniable. Think overnight millionaires and Cinderella stories. But the flip side is equally harsh. You can lose your entire stake just as quickly.

- Investing: While windfalls are rare, the potential for steady growth is real. Over time, the power of compound interest can turn even small investments into significant sums.

Ownership:

- Betting: You’re wagering on an outcome. You win or lose cash, but you don’t own anything tangible. You’re not part of the game, just a spectator with a vested interest.

- Investing: You’re buying a piece of a company and becoming a stakeholder. You’re not just betting on the outcome, you’re invested in the journey.

Duration of Investing and Betting

When it comes to betting, it’s all about the immediate thrill. You win or lose within minutes, or a few days at most. Instant gratification? Absolutely. Long-term wealth building? Not so much.

Think of investing as marathons, not sprints. You’re planting seeds today to reap the harvest years, even decades, down the road. Patience and a long-term vision are your best friends here.

The Concept of “House Edge” in Betting and “Market Efficiency” in Investing

No matter your betting skills, one thing is certain – the house always has an edge. House edge in sports betting is the built-in advantage that ensures the sportsbook will make money even if players occasionally win.

This is usually achieved through the point spread, which handicaps the teams to create a more balanced betting proposition.

For example, if the favoured team is expected to win by 7 points, they might need to win by 8 or more points for a bet on them to be successful. This means that even if your team wins, yet they only scored 6 points, you still lose. Your bet will then contribute to the sportsbook’s profit.

As for market efficiency in investing, imagine a giant stock exchange where every trade, news headline, and rumour instantly gets factored into the price of the stocks.

In this efficient market, hidden gems are hard to come by, as everyone has access to the same information, making it challenging to outperform the market consistently. However, it’s important to remember that this isn’t an exact science. There will always be some market inefficiencies that skilled investors can identify and exploit.

Expected Returns and Diversification

Whether you’re cheering on your favourite team or tracking your portfolio growth, the thrill of potential gains is a powerful motivator. But before you get to that, let’s first try to understand the expected returns in betting vs investing.

After careful thinking and thorough research, let’s say you’ve already placed your bet. But have you considered the expected return of your wager?

In sports betting, the expected return is usually negative due to the built-in house edge, but you can still win big and defy the odds. However, relying solely on luck is not enough.

Aside from researching stats and whatnot, you can also spread your wagers across different events, sports, and even betting types to mitigate risks!

If you’re thinking of investing, know that market efficiency can influence expected returns. But what does this actually mean? Well, it implies that your long-term returns should roughly align with the market average.

For example, investing in a broad market index fund like the S&P 500 can give you an expected return of around 10% per year over the long haul. However, efficient markets don’t erase the importance of diversification.

Psychological Aspects

It’s not all numbers and charts in the financial arena. In fact, there’s the psychological aspects of choosing between betting and investing. Our emotions, biases, and even basic human psychology play a significant role in every decision we make, including those related to betting and investing.

Emotional Involvement and Discipline

Remember the electrifying feeling when you won your last bet? That feeling of elation? That’s dopamine, the biggest contributor to your decision-making process in the psychology of sports betting.

Dopamine floods your brain with pleasure and makes you crave that experience again and again. But it doesn’t care about logic, it just wants to make you feel good. So, you might find yourself chasing that next big win, even if it means ignoring the odds stacked against you.

Even investing in the stock market is affected by fear and greed. When the market heads for a downturn, it can trigger fear and lead to panic selling. Conversely, rising markets might tempt you to chase after hot stocks and overlook potential warning signs.

Discipline in sports betting and investing serves as a counterweight to emotional involvement. In sports betting, discipline can be setting limits, sticking to a betting strategy, and avoiding emotional reactions to losses.

For investors, discipline means maintaining a long-term perspective, adhering to an investment plan, and avoiding hasty decisions based on market noise.

Loss Chasing and Market Panic

Still fueled by dopamine, you may be more than disappointed when your bets start losing. This is where loss-chasing makes you wager bigger bets, ignore your pre-set limits, and essentially just try to win again.

In the same way, the stock market can also become a breeding ground for market panic. In the psychology of investing, market panic can trigger a fight-or-flight response, leading to impulsive choices that ignore the whole concept of market efficiency.

How to Choose What is Right for You

So, you’ve weighed the opportunities in betting against the potential of investing. You’ve delved into its psychological aspects, including the realities of loss-chasing and market panic. Now comes the crucial question: which path is right for you?

There’s no one-size-fits-all answer. But to give you a better idea of which is better for you, here’s how to choose between betting and investing:

Assessing Your Risk Appetite

Whether you prefer sports betting or the long-term game of investing, one factor separates the thrill-seekers from the cautious players: risk appetite.

Assessing your risk appetite for betting:

- Do you love the adrenaline rush of a close call, even if it means losing?

- Are you comfortable with the idea of potentially losing your entire wager?

- Can you handle the emotional rollercoaster of wins and losses without letting it impact your financial well-being?

If you answered yes to these questions, you might have a high-risk appetite for betting. You thrive on the excitement and potential for big wins, even if it means significant losses.

Assessing your risk appetite for investing:

- Can you stomach market downturns without panicking and selling your assets?

- Are you comfortable with the idea that your investments might not always grow quickly?

- Are you willing to stay invested for the long term, even when faced with tempting short-term opportunities?

If you answered yes to these questions, you might have a moderate risk appetite for investing. You understand that growth takes time and are comfortable with calculated risks in exchange for potential long-term gains.

Your Financial and Life Goals

Other questions to ask yourself are: Where do you want to go? What are your financial goals and life aspirations?

- If you’re looking to fund a short-term goal like a new gadget or a vacation and enjoy the thrill of sports betting, then by all means, go for it.

- But investing is your best bet if you’re patient and desire long-term financial aspirations like retirement, education, or wealth creation.

The Time You Are Willing to Devote to Research and Learning

Let’s face it: Not everyone has the same number of spare hours. But here’s how you can tell which is better for you according to how much time you can commit:

- If you have limited time for research and analysis, favour intuitive decision-making, and enjoy the prospect of immediate rewards, sports betting could be an ideal choice for you.

- If you’re willing to dedicate time and effort to building your financial knowledge base, give investing a shot.

The Balance Between Betting and Investing

Regardless of which one you choose, know that it’s not always an either/or situation. You can enjoy both to create a financial strategy that aligns with your goals.

For example, you can use a small portion of your disposable income for occasional bets while saving the rest for investments.

The Path to Financial Literacy

Financial literacy isn’t just about comparing the similarities and benefits of sports betting vs investing. It’s about understanding your financial status, identifying your goals, and working on them for a better future.

The journey to financial literacy in the context of betting and investing is a continuous process. So embrace the learning curve, don’t be afraid to ask questions, and seek guidance from trusted sources. Remember, every step you take, and every book you read adds to your knowledge!